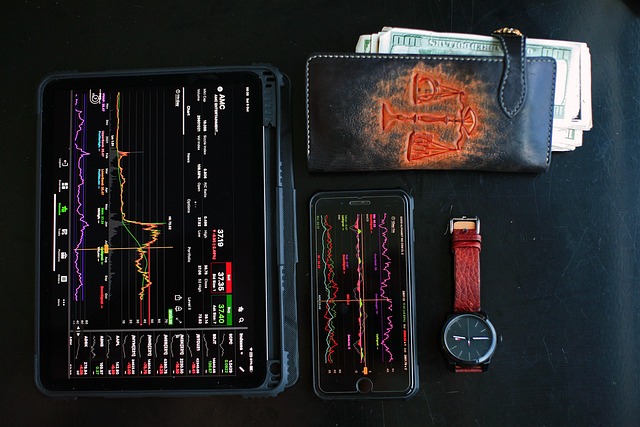

The Ultimate Investing Guide for Beginners

Investing can seem daunting for beginners, especially with the myriad of choices available and the complex terminologies often employed. Yet, understanding the fundamentals of investing is essential for building wealth and securing financial stability over time. This guide aims to simplify the key concepts and strategies you need to know to embark on your investing journey with confidence.

Understanding the Basics of Investing

At its core, investing involves putting your money to work in order to earn a return. This can be achieved through various assets, including stocks, bonds, real estate, and mutual funds. The ultimate goal is to grow your initial capital to achieve financial independence.

Before starting, it’s crucial to understand some foundational concepts:

What is Risk?

All investments come with a level of risk. This refers to the possibility of losing money or not achieving expected returns. Understanding your risk tolerance, which is your ability and willingness to lose money, is key to making informed investment decisions. Risk can vary depending on the type of investment; generally, stocks are considered riskier than bonds.

Return on Investment (ROI)

ROI measures the profitability of an investment. It is calculated by taking the profit made from an investment, subtracting the initial cost, and then dividing by that same cost to express it as a percentage. Understanding ROI can help you compare different investment opportunities to decide where to put your money.

Setting Investment Goals

Before you start investing, it’s vital to define your financial goals. Ask yourself the following questions:

What are you investing for? Is it retirement, a home purchase, or your children’s education? Having clear objectives will shape your investment strategy. Consider your timeline as well—different goals may require different investment approaches. For example, short-term goals may call for less risky investments, whereas long-term goals can accommodate more volatility.

Types of Investments

There are several types of investments in which you can allocate your money. Understanding these options can help you diversify your portfolio, which is crucial for managing risk.

Stocks

Buying stocks means purchasing shares in a company, making you a part-owner. Stocks can offer high returns but also come with higher risks. They are typically categorized as:

- Common Stocks: These provide ownership in a company and a right to vote at shareholder meetings.

- Preferred Stocks: These usually offer no voting rights but provide dividends, which are typically higher than those paid on common stock.

Bonds

Bonds are essentially loans made to governments or corporations. When you buy a bond, you are lending your money in exchange for periodic interest payments and the return of the bond’s face value upon maturity. Bonds are generally viewed as less risky than stocks.

Mutual Funds

Mutual funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities. This diversification can reduce risk for individual investors. Mutual funds come with fees, which can affect investment returns, and can be actively or passively managed.

Real Estate

Investing in real estate can provide rental income and capital appreciation. It is a tangible asset and can be a great hedge against inflation, but it requires significant capital and involves costs like maintenance and property taxes.

Exchange-Traded Funds (ETFs)

Similar to mutual funds, ETFs hold a basket of securities but trade on stock exchanges like individual stocks. They offer flexibility and can be bought or sold throughout the trading day.

Understanding Investment Strategies

Once you choose your investments, it’s essential to adopt an effective strategy. Here are key strategies every investor should consider:

Active vs. Passive Investing

Active investing involves frequent buying and selling of stocks, trying to outperform the market through research, analysis, and timing. While potentially offering higher returns, it requires a significant time commitment and expertise.

On the other hand, passive investing involves buying and holding investments for the long term, relying on market averages. This strategy often leads to lower costs and less stress.

Diversification

Diversification is crucial in managing risk. By spreading your investments across various asset classes, industries, and geographies, you can mitigate the impact of poor performance in any single area. The idea is that different assets perform differently under varying market conditions.

Learning the Market Mechanics

Familiarize yourself with how the stock market operates, including market orders, limit orders, and trading hours. Understanding how to buy and sell securities is foundational for any investor.

Market Orders vs. Limit Orders

A market order buys or sells a stock at its current market price, ensuring a quick transaction. In contrast, a limit order sets a specific price at which you’re willing to buy or sell, allowing you to control your entry and exit points but requiring patience.

Trading Hours

Know the trading hours of the exchanges you are using. The NYSE and NASDAQ, for instance, typically operate from 9:30 AM to 4 PM EST on weekdays. Many brokerages also offer pre-market and after-hours trading, but this can come with higher risks and lower liquidity.

Choosing the Right Brokerage

Selecting a brokerage platform is a critical step in your investing journey. Consider these factors:

Fees

Look for platforms with low trading fees, minimal account fees, and no hidden charges. Some brokerages offer commission-free trading for stocks and ETFs.

Tools and Research

Evaluate the research tools and educational resources provided. Quality resources can help you make informed decisions, especially as a beginner.

Customer Support

A responsive customer support team can be invaluable, particularly when you run into issues or have questions about your investments.

Building and Managing Your Portfolio

Your investment portfolio is a collection of your investments. Building and managing a well-structured portfolio aligned with your goals is vital to your financial success.

Regular Review and Rebalancing

It’s important to regularly review your portfolio to ensure it aligns with your investment goals. Market fluctuations may shift your asset allocation. Rebalancing involves adjusting your portfolio back to your target allocation, ensuring you maintain your desired level of risk.

Staying Informed

Investing isn’t a one-time act; it’s an ongoing process. Stay informed about market trends, economic indicators, and news that might affect your investments. Continuous learning will empower you to make better investment decisions.

Common Mistakes to Avoid

As a beginner, it’s easy to make mistakes that could significantly impact your financial future. Here are common pitfalls to watch for:

Emotional Investing: Making impulsive decisions based on emotional reactions can lead to buying high and selling low. Stick to your research and strategy.

Lack of Research: Investing without understanding the assets or the market can lead to poor decisions. Always conduct thorough research.

Timing the Market: Trying to predict market highs and lows is notoriously difficult, even for seasoned investors. A more effective strategy often involves a long-term perspective.

The Importance of Patience

Finally, one of the most crucial elements of investing is patience. Building wealth through investments is a long-term endeavor, typically involving ups and downs. Stay focused on your goals and understand that markets can fluctuate over time. Relying on historical data suggests that while markets can be volatile in the short term, they tend to rise over the long term.

Conclusion

Getting started with investing may seem intimidating, but by understanding the basic principles, exploring various investment types, setting clear goals, and developing a solid strategy, beginners can confidently move forward. Remember that investing is a journey, not a sprint. Educate yourself continually, manage your portfolio wisely, and stay committed to your financial goals. With time and experience, you will be well on your way to becoming a successful investor.

Always consult with a financial advisor if you feel overwhelmed or need personalized guidance tailored to your specific circumstances. Happy investing!